In an effort to facilitate economic recovery post-COVID, the Australian Government has introduced new tax incentives known as instant asset write-offs.

From 6 October 2020 until 30 June 2022, businesses with an aggregated turnover of less than $500 million can claim an immediate deduction for the business portion of the cost of an asset. The threshold amount for each asset is $150,000 and can be used across multiple assets, if the cost of each individual asset is less than $150,000.

This incentive has been kindest to those hit hardest by the economic downturn, with a package for small businesses (with an aggregated turnover under AUD$10 million) being allowed to immediately deduct the entire closing balance of the general small business pool, if the balance at year-end (ignoring current year depreciation deductions) is below the instant asset write-off threshold.

Sullair Australia customers large and small have been signing up for the CapEx tax break after a particularly difficult year in 2020.

“Products from our whole portfolio, from oil-free to oil-injected to custom setups and spare parts have been purchased by our customers with help of the scheme – the end of the financial year is a great time to invest in your compressed air solutions.”, says Nick Shepherd, Marketing & Sales Manager for Sullair Australia.

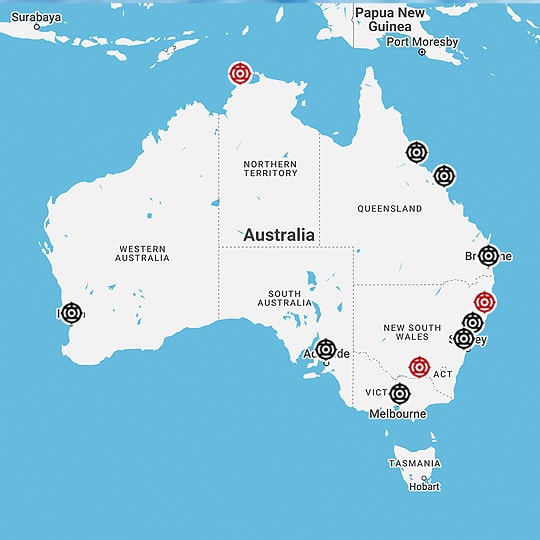

If you are interested in how you can learn more about using your instant asset write-off with Sullair, contact us today or browse our extensive product offerings. Whether it’s portables, oil-free, electric or diesel, Sullair Australia’s compressed air equipment has been built to last and expertly adapted for Australia’s conditions.

Want to find out more?

Get in touch today to find out how you can make the most of your $150k instant asset write-off.